Last week, I made the case to purchase Zynga stock in anticipation of their August 6th Q3 report. (BTW, you’ll be able to find the Q3 earnings report and conference call link on the Zynga Investor Relations site.) At the time, ZNGA was trading around $2.85 per share. Since then, the stock has dropped to around $2.60, recovering to around $2.70 at the time of writing this post.

My apologies to anyone who purchased on my recommendation last week and is now down about 5%. The thesis was to hold through earnings though, so hopefully you didn’t get scared out. It’s important to know both your exit from a trade and your tolerance for pain while holding through the trade. If you’re really following me, you are still holding. If you end up losing money after earnings, I apologize again, but I am not a financial adviser… this is not financial advice… please don’t sue… etc etc.

In my case, I’m bullish on Zynga as a company long term and looking to purchase as many shares as possible as cheaply as possible. I feel that $2.50 and definitely $2.00 are very strong support for the stock price and so barring any big screw ups in the company, it’s unlikely to go much lower than it is now. I think the current quarter’s earnings are likely to be good because the company has been turning around in general and also because their games have maintained high ranks in the app store “top grossing” charts while new games have come out. Existing games have had their video ad systems updated, and there is growth in general in both smartphone use and ads on smartphones. So things should be good. If they are, this might be my last chance to load up on Zynga stock before it starts to get expensive.

My Zynga holdings are about 8% of my retirement fund, which is on the mid to high side. I’m hesitant to add more, but I’ve also been hesitant to add more to other companies I had hunches about like this, and I’m trying to trust my gut more… especially when stocks are trading in value territory with lots of support. It would have been nice of me to have bought more Tesla, Amazon, and Activision at their recent lows. So I wouldn’t mind adding here even more before earnings.

Then the question becomes, what is the best way to add to my position? Should I buy more stock? Or purchase out of the money call options?

1. Just Buying Shares

This case is easy to analyze. I can buy about 300 shares at $2.7 each for a total of $810. If the stock moves to $3.10, I’ll make $0.40 on each share or $120. I’ll also have 300 shares in Zynga stock going forward. For my long term focused fund, it’s almost more important to track how many shares of a company you have (the assumption being you’ve picked great companies that will be valuable in the future) vs how much the stock price is up from your basis.

If earnings are poor or just not good enough and ZNGA shares trend lower, I’ll obviously lose X cents per share on 300 shares. Here is where things would stand at various price points:

$2.30: -$120

$2.60: -$30

$3: $90

$3.10: $120

$3.25: $165

$3.50: $240

2. Purchasing Call Options

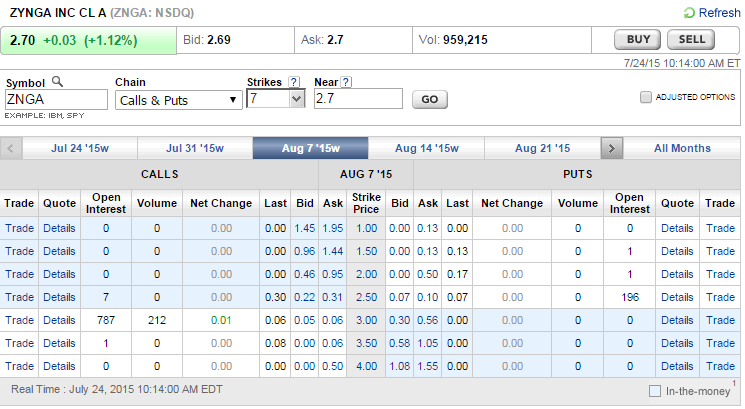

When you consider buying options, things can get complicated. When purchasing stock, there’s basically two things you can do: purchase stock at the market price or wait. With options, you have to figure out not only when to buy but at which strike price and on which strike date. Here’s a view of the Zynga options chains in Etrade.

Figuring out which options to buy can be confusing and is the topic for another post (maybe there is one in our archive), but for now let’s assume I choose the options striking on August 7th (one day after the earnings call) at $3.00 (a good balance of risk reward).

Buying 140 contracts at $0.06, conveniently comes to $810. That would be $0.06 x 100 (100 options per contract) x 140 contracts. This purchase would give me the “option” to purchase 14000 shares of ZNGA stock at $3 per share. If the stock never gets to $3/share on August 7th, the options would expire worthless and I’d be out $810. If they got to $3.06 per share, I would just about break even. I’d be able to buy 14000 shares at $3 for $42k and then sell them at $3.06 for $42.8k. He’s what I would make or lose at different prices on August 7th:

$3 and below: -$810

$3.06: $0 (breakeven)

$3.07: $140 (about same as buying 300 shares)

$3.25: $3500

$3.50: $7000

As you can see the potential rewards are higher, but there is a bit more risk since I could lose all $810 invested. On the other hand, there is very little chance I would lose the total $810 invested in the “just buy stock” option. So let’s make a buy stock scenario that has a similar amount of risk.

3. Buying Shares with a Stop Loss

What is instead of buying 300 shares of ZNGA stock worth $810, we bought a higher number of shares and used a stop loss to limit our downside risk to $810. What might this look like? The first step would be to figure out a good place for that stop loss. Recently ZNGA got down to $2.60, but didn’t go lower. The current 200 day moving average is also hovering right around that number providing support. There is support at $2.60, so let’s place our stop loss there… 10 cents below the current $2.70 price.

If we bought 8100 shares at $2.70, we could set a stop loss at $2.60. Assuming no slippage (i.e. our stop loss actually fires at $2.60 when the stock gets that low), we would only lose $810 on those shares if the stock price went lower. Here’s what we would earn at the same price levels as in the options scenario:

$2.60: -$810

$3: $2430

$3.06: $2916

$3.07: $2997

$3.25: $4455

$3.50: $6480

In this scenario, we would risk the same $810, but stand to make even more than purchasing $3 options would. In some ways there is less risk in this scenario, since we still make money (a lot actually) if the stock doesn’t trade above $3. We also have the option of holding the shares past August 7th if we want to.

In some other ways, there is a lot more risk though. If ZNGA is trading at $2.65 before earnings, then reports terrible earnings and opens the next day at $2.30. There is a chance my stop loss would sell below my target and we could lose something like $3000 or more selling those shares for a loss. Oops.

The other thing to note in this scenario is that you would need to come up with $21.8k to purchase those shares, which is more than my current holdings. One option would be to go on margin to get that money. Generally, that’s a bad thing to do without knowing what you are doing. Purchasing options is actually one way to effectively trade on margin, but with fixed costs.

What am I going to Do?

I’m not sure yet. The options option looks nice as a way to gamble an extra $810 on this next earnings with a fixed amount of downside risk. Buying shares could be good as well, but I would do something between Option #1 and #3 above. For example, instead of buying them all at once, I could buy 3000 or so and then buy 3000 more if earnings were bad (and I still believed in the company). I’d have lost money, but would have even more invested in the company ready for the turn around. This is basically the strategy of my portfolio. It’s worked well for me with Netflix, Tesla, Activision, and currently Nintendo. Of course, I could get unlucky and average down on a company like this that drops to $0. The idea is I would hopefully make up for it with my winners… or basically be able to make good judgements to cut my losses when I really need to.

If I figure out what I’m going to do. I’ll post an update. Good luck everyone!