Microsoft is a core holding for me. It’s the #1 position in my main brokerage account and about 7% of my retirement account.

A little bit of history. I held Microsoft through some flat years 2003-2013 or so. In 2014, Satya Nadella came in as CEO and brought MSFT back as a growth stock. Since then, I’ve watched from the sidelines. I was kind of burnt out and avoided investing in MSFT vs other opportunities (which did really well too). Sometime in 2023, I felt I wanted to get back in and have been building a position over the past year.

Microsoft is a well managed business with software and service products across all areas of our lives. Despite falling market share in desktop computers, Windows is still run on the majority of PCs. Despite Google Docs and making headway in office software, and Office365 subscription is still a mandatory purchase for nearly ever single employee of a fortune 5000 business.

My main thesis for Microsoft’s continued relevance is “developers, developer, developers”. GitHub, VSCode, and their more favorable approach to open source software means practically all developers work with Microsoft platforms. And while GitHub and VSCode don’t bring in much money themselves, developers and businesses using those tools are more likely to use other Microsoft products like Windows, Office, and most of all… their cloud computing platform Azure.

Lately Microsoft has made waves with their large investment into OpenAI. Their close relationship with OpenAI and Nvidia make Azure an especially compelling platform for AI related cloud computing, which should grow a ton over the next 5 to 10 years. Why? Every app or website you use is basically hosted on one of the big 3 cloud platforms. For the most part, these apps and websites have been buying CPU power and hard drive space. The adoption of new AI applications means everyone needs to buy GPU power as well now, giving Microsoft and the other cloud providers dry powder for revenue expansion for the next 5-10 years. If Microsoft does a better job of building AI-first cloud computing services, could they perhaps flip with Amazon as the #1 cloud computing provider?

So how is MSFT stock doing?

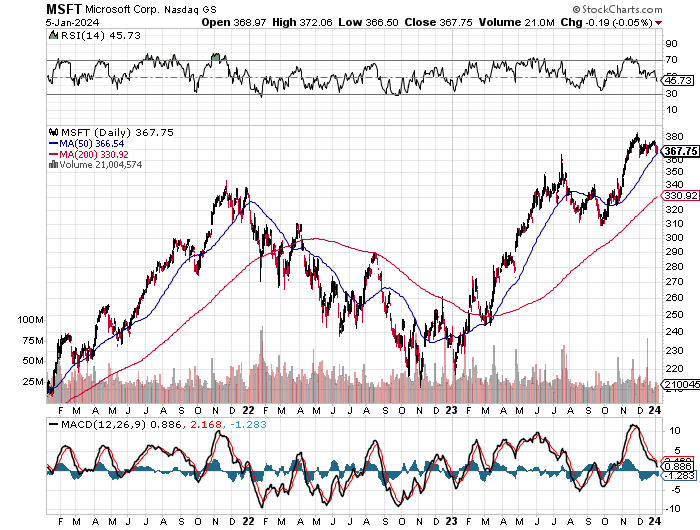

I like the default chart at stockcharts.com for getting an idea of how a stock is doing based on the recent price action. (I’ll break down all the components of these charts in another post, but for now will focus on what stands out to me today.)

That’s a striking return the 50 day moving average. You can draw a horizontal line at that $365 line as well, so there looks to be strong support there, meaning this could be a good time to buy. Even when it’s a good time to buy, there could be even better times to buy. i.e. the price could drop further.

If the price action breaks below $365, it looks like the next line of support is around the $320-$340 range, right around where the 200 day moving average is right now, which would be another price to load up at.

This is how I look at stock charts and the support/resistance lines that show up in the technical analysis. Assuming we all think it’s a good company with stock that is worth owning, when would it be better to buy? The stock will go up and down, and should tend to slow down around these TA lines. Depending on your level of confidence and how badly you want into the stock, you will be more or less willing to wait for a better entry.

For me, Microsoft is already one of my biggest positions. So I’m not in a hurry to add. But I am looking out for opportunities to add on if the price pulls back. Knowing these support levels in advance, makes it so I can buy the stock faster in the future if and when it hits those levels.

The recent price action makes sense in a market that seems to be rotating out of the big tech stocks that had big gains last year into financials and other stocks. If we’re in the middle of a bull market, we’d expect MSFT to continue to run up without spending too much time below the 200 DMA.

I also like zooming out to the 3 year chart to get more context.

Here we can see the 2022 high that MSFT broke through last year. Which makes the support around $340 even stronger. We’re just looking at the technicals for now, but it seems to me that for MSFT to trade below $340 something would have to be broken. We could see some accumulation in this area this year or maybe the move up will continue after bouncing off that 50 or 200 DMA. But if you feel that MSFT is going to be a big player in proliferation of AI chips and compute everywhere, this could be a good time to buy in.

Let’s take a look at some of the fundamentals. I’m getting these numbers from Etrade.

- Price to Earnings (PE): 35.63

- Price to Sales (PS): 12.52

These are the first 2 metrics I look at to get an idea for where a stock is at. These are above average, relatively “frothy” numbers. The average PE for all companies in the S&P 500 is about 24.59. Theoretically, if the market decided Microsoft was no better than any other company in the S&P, then the PE would fall down towards the average.

In reality, analysts expect Microsoft to continue to grow both revenue and earnings by 15% or so per year for the next few years. These are solid numbers for a company of Microsoft’s size, and help MSFT to warrant a PE premium. I think if Microsoft “just” hits these numbers or comes in below estimates, then the stock will suffer and move back towards that market average PE, which could be a $100 dollar move down.

An exercise for another time is to head check those analysts estimates. Can we do better? Will Microsoft’s advantage in AI materialize in sales and earnings sooner than expected? Are analysts over estimating the chance Bing will take advertising share from Google? I would do what I call “Main Street” analysis, which means sitting down with a spreadsheet and trying to come up with a simple model of how Microsoft makes money. What does it sell? How much and at what margins? If things grow at 15% per year for 5 years, what does that mean? Is it more computers than humans on the planet? Does that even make sense. These kind of things come out in the Main Street analysis.

So far based on the recent technical analysis and Microsofts above average PE and PS numbers, I would rate it a hold for myself (as someone who already owns a whole lot). I’m not missing this boat. It’s not really on sale right now in my opinion.

I will keep an eye on the stock and if the 50 DMA breaks, I’ll think about adding at the 200 DMA around $330. If that breaks, I’ll look to load up as close to $260 as possible, which feels like a level we shouldn’t see MSFT trading at without some kind of larger issue in the company or market in general.

Of course, when stocks pull back 30%, there usually is some negative narrative about the company or the larger market that preceded the move. I’ll continue to tune into the earnings calls and follow the earnings reports to make sure I still feel confident in Microsoft’s ability to out perform. If I build my own narrative about the company, I can buy the stock at depressed levels when the market overreacts about something I’m not as concerned about. We’ll see.