This post is inspired by a post by the user cyice on Stocktwits, who said: “when are the fundamentals of the stock ever going to take charge of its price“.

At $110 a share, Apple ($AAPL) is down around $20 or 16% from it’s highs just over $132. The stock trades at a PE ratio of 13. Minus the $200B in cash Apple has, that’s a PE of about 9. Meanwhile, companies like Google and Microsoft trade at PEs of 20 and 32 respectively.

I won’t go into why the market thinks Apple deserves a PE 1/2 of other tech companies (I wrote it up and decided to scratch it — the market is crazy and crazy hard to understand). If we just assume that the market has different rules for Apple, we can try to figure out what those rules are.

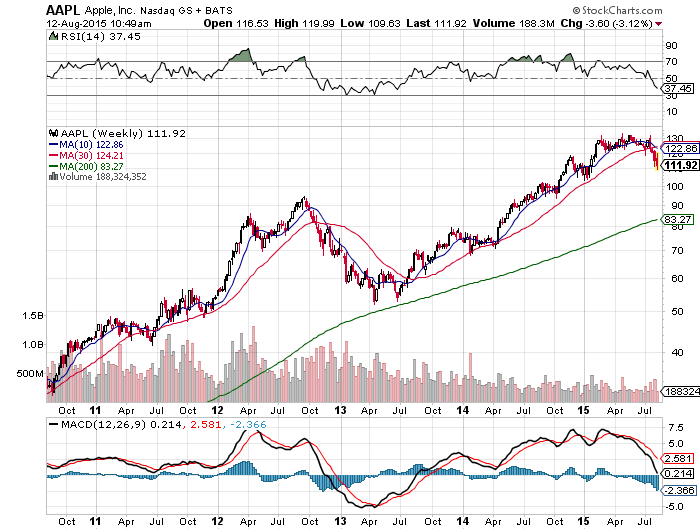

A chart…

In July 2013, Apple traded at $60 with a PE around 10. It touched $130 this year and a PE around 15 and now trades at $110 with a PE around 13. Also notice how the price bounced off the 200 day moving average in July 2013.

So one answer to the “when are the fundamentals of the stock ever going to take charge of its price” would be around a 10 PE, which would correspond to a price of about $90 and also come close to that 200DMA. I’m long Apple in a retirement account and would back the truck up if it dips down around this area.